Understanding the Wall Street Prime Rate is crucial for anyone involved in financial decision-making, from institutional investors to corporate finance professionals and startup entrepreneurs. As a seasoned financial analyst, I aim to provide clear and precise insights into this key financial indicator.

The Wall Street Prime Rate, often referred to simply as the Prime Rate, is the interest rate that major banks charge their most creditworthy customers. It serves as a benchmark for various loans, including small business loans, personal loans, and credit card rates. The Prime Rate is pivotal because it influences the interest rates set by banks for different financial products.

How is the Prime Rate Determined?

The Prime Rate is determined based on the Federal Funds Rate, which is set by the Federal Reserve. Typically, the Prime Rate is about 3% higher than the Federal Funds Rate. This spread covers the risk and cost of lending. When the Federal Reserve adjusts the Federal Funds Rate, banks usually follow suit by adjusting their Prime Rates.

Why is the Prime Rate Important?

Understanding the current prime rate is essential for making informed financial decisions. The Prime Rate impacts both consumers and businesses, influencing the cost of borrowing and the returns on investments.

For Institutional Investors

For institutional investors, the Prime Rate provides a gauge of economic conditions. A lower Prime Rate generally indicates an attempt by the Federal Reserve to stimulate economic growth, making borrowing cheaper and potentially boosting investment returns. Conversely, a higher Prime Rate can signal efforts to curb inflation, impacting borrowing costs and investment strategies.

For Corporate Finance Professionals

Corporate finance professionals must consider the Prime Rate when developing financial strategies. Changes in the Prime Rate can affect a company’s cost of capital, influencing decisions on financing, investment, and capital structure. Understanding regulatory shifts and their impact on the Prime Rate can help optimize risk management and financial planning.

For Startup Entrepreneurs

Startup entrepreneurs, especially those leveraging fintech solutions, need to understand how the Prime Rate affects their cost of capital. A lower Prime Rate can reduce the cost of borrowing, facilitating expansion and innovation. Conversely, a higher Prime Rate may necessitate reevaluating financing strategies and exploring alternative investment opportunities.

The Current Prime Rate and Economic Indicators

As of now, the Wall Street Journal Prime Rate, which is the most commonly used Prime Rate, provides a snapshot of the current economic climate. It reflects the Federal Reserve’s stance on monetary policy and serves as an indicator for economic growth and inflation.

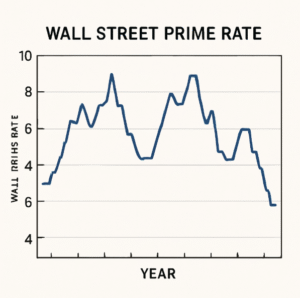

Historical Context

The Prime Rate has experienced fluctuations over the decades, responding to economic conditions and monetary policy changes. Understanding these trends helps forecast future movements and prepare for potential impacts on various financial sectors.

How the Prime Rate Affects Different Sectors

Banking and Finance

In the banking sector, the Prime Rate influences the interest rates on savings accounts, mortgages, and other financial products. Banks adjust their rates based on changes in the Prime Rate, affecting both lenders and borrowers.

Real Estate

In the real estate market, the Prime Rate impacts mortgage rates. Lower rates can stimulate the housing market by making home loans more affordable, while higher rates can dampen demand.

Consumer Spending

The Prime Rate also affects consumer spending, as changes in interest rates influence credit card rates and personal loan costs. Lower rates can encourage spending, while higher rates may lead to reduced consumer activity.

Forecasting the Prime Rate

Forecasting the Prime Rate involves analyzing economic indicators such as inflation rates, employment data, and GDP growth. Financial analysts use these indicators to predict changes in the Federal Funds Rate, which in turn influences the Prime Rate.

Potential Scenarios

Several scenarios could influence the Prime Rate in the future. For instance, a robust economic recovery could lead to an increase in the Federal Funds Rate, thereby raising the Prime Rate. Conversely, an economic downturn might prompt the Federal Reserve to lower rates to stimulate growth.

Strategic Implications

For institutional investors, corporate finance professionals, and startup entrepreneurs, understanding potential shifts in the Prime Rate is crucial for strategic planning. Being prepared for rate changes can help optimize investment strategies, manage risks, and capitalize on opportunities in evolving financial markets.

Conclusion

The Wall Street Prime Rate is a vital financial indicator that impacts various sectors of the economy. By understanding how it is determined, its historical context, and its effects on different industries, financial decision-makers can better navigate the complexities of global capital markets. Whether you’re an institutional investor seeking higher returns, a corporate finance professional optimizing capital structure, or a startup entrepreneur leveraging fintech solutions, staying informed about the Prime Rate is essential for strategic success.