The 1920s, often referred to as the “Roaring Twenties,” were marked by economic prosperity and technological advancements. This period witnessed a remarkable transformation in industrial productivity and consumer lifestyles, laying the groundwork for modern economic practices. The U.S. economy expanded rapidly, with industries like automobiles and consumer goods leading the charge, driven by mass production techniques and innovative marketing strategies.

Technological Innovations

The era was characterized by breakthroughs that revolutionized various sectors. The automobile industry, spearheaded by pioneers like Henry Ford, saw unprecedented growth, making cars accessible to the average American. This not only boosted the automotive sector but also catalyzed the development of related industries such as steel, rubber, and oil. Similarly, advancements in telecommunications, with the proliferation of radio and telephone technology, transformed communication and advertising, contributing to consumer culture.

Consumer Credit Expansion

The expansion of consumer credit was a significant factor in the economic boom. Installment buying became popular, allowing consumers to purchase goods like cars and household appliances on credit. This credit expansion fueled consumer spending, driving demand and production. However, it also led to increased household debt levels, which would later contribute to the economic instability of the late 1920s.

Stock Market Mania

The stock market became a symbol of prosperity, attracting a broad spectrum of investors. The culture of speculation was rampant, with individuals from various walks of life investing heavily in stocks. The belief in perpetual growth led to soaring stock prices, further fueled by optimistic media coverage and widespread public enthusiasm. This environment created a fertile ground for the speculative bubble that would eventually burst.

Speculative Bubble

The rapid economic growth led to an increase in speculative investments. Investors, buoyed by optimism, poured money into the stock market, driving prices to unsustainable levels. This speculation was not limited to seasoned investors; it permeated society, with many first-time investors joining the frenzy in hopes of quick profits.

Margin Buying Practices

Margin buying, a practice where investors borrowed money to purchase stocks, further inflated prices. This practice allowed investors to magnify their investments, increasing potential returns. However, it also amplified risks, as a decline in stock prices could trigger margin calls, forcing investors to sell their holdings at a loss. The widespread use of margin buying contributed significantly to the bubble’s growth.

Media Influence and Public Perception

Media played a crucial role in perpetuating the speculative frenzy. Newspapers and radio broadcasts often highlighted stories of overnight fortunes, reinforcing the narrative of endless market growth. This media-driven optimism influenced public perception, encouraging more individuals to invest without fully understanding the risks involved. The societal pressure to participate in the stock market created a feedback loop, driving prices even higher.

Disconnect from Economic Fundamentals

As stock prices soared, they became increasingly disconnected from the underlying economic fundamentals. Many companies had inflated valuations that did not reflect their actual financial performance. This disconnect was exacerbated by a lack of transparency and reliable financial reporting, making it difficult for investors to assess true company values. The disparity between stock prices and economic reality set the stage for an inevitable correction.

Lack of Regulation

The financial landscape of the 1920s was largely unregulated. This absence of oversight allowed financial institutions to engage in risky and often unethical practices, contributing to market instability. Banks and investment firms operated with minimal restrictions, prioritizing short-term gains over long-term stability.

Risky Banking Practices

Banks engaged in practices such as investing depositor funds directly into the stock market. This intertwining of banking and speculative activities increased systemic risk, as banks’ fortunes became tied to volatile market conditions. The lack of regulation meant there were no safeguards to prevent such risky behavior, leaving the financial system vulnerable to shocks.

Market Manipulation Tactics

Market manipulation was rampant, with practices such as stock pooling and insider trading going unchecked. Wealthy investors and financial institutions often collaborated to artificially inflate stock prices, luring unsuspecting investors into overvalued securities. These manipulative tactics contributed to the market’s unsustainable rise and exacerbated the eventual crash.

Absence of Regulatory Framework

The absence of a robust regulatory framework allowed for unchecked speculation and market abuse. There was no central authority to monitor or intervene in the market, leaving investors exposed to fraud and financial misconduct. This lack of regulation highlighted the need for comprehensive reforms to protect investors and ensure market integrity.

Warning Signs and the Initial Collapse

By the late 1920s, signs of economic instability began to emerge. Despite these red flags, the stock market continued its upward trajectory, fueled by speculation and borrowed funds. However, the market’s resilience was superficial, masking underlying vulnerabilities that would soon be exposed.

Economic Indicators of Instability

Industrial production began to plateau as consumer demand reached saturation. Key sectors, such as construction and manufacturing, showed signs of slowing growth. Simultaneously, agricultural prices suffered due to overproduction, leading to financial strain for farmers. These indicators suggested that the economy’s foundation was weakening, even as the stock market thrived.

Overvaluation and Investor Complacency

Stock valuations reached unsustainable levels, with price-to-earnings ratios far exceeding historical norms. Despite this overvaluation, investor complacency prevailed, driven by a belief in perpetual growth. The disconnect between stock prices and economic fundamentals was apparent, yet many investors remained oblivious to the risks, blinded by recent gains.

Early Warning Signals Ignored

Several warning signs were evident, such as rising interest rates and tightening credit conditions. Financial experts and economists cautioned against the speculative excesses, but their warnings went largely unheeded. The prevailing optimism and trust in the market’s infallibility led many to dismiss these signals, setting the stage for the impending crash.

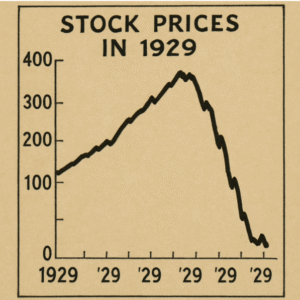

Black Thursday and Black Tuesday

The stock market’s decline began on October 24, 1929, known as Black Thursday, when panic selling ensued, and the market lost 11% of its value at the opening bell. This initial shock was a prelude to the more devastating events that followed, marking the beginning of the end for the speculative bubble.

The Immediate Impact of Black Thursday

The panic selling on Black Thursday was driven by a sudden loss of confidence. As prices plummeted, investors scrambled to liquidate their holdings, further driving the market downward. Efforts by major banks to stabilize the market provided temporary relief, as they pooled resources to buy stocks and restore confidence. However, this intervention was insufficient to halt the broader market decline.

The Unfolding of Black Tuesday

On October 29, 1929, known as Black Tuesday, the market experienced an even more dramatic collapse. The lack of buying support and overwhelming sell orders led to a freefall in stock prices. The market lost nearly 12% of its value in a single day, erasing billions of dollars in wealth. This catastrophic event shattered investor confidence and marked the definitive end of the market’s speculative era.

Psychological Dimensions of the Collapse

Investor psychology played a significant role in the crash. The rapid decline in stock prices triggered a self-reinforcing cycle of fear and panic. As investors rushed to sell, prices fell further, exacerbating the sense of urgency and despair. This psychological contagion highlighted the impact of emotions on market dynamics, a lesson that remains relevant in today’s volatile financial environments.

The Role of Panic

Investor psychology played a significant role in the crash. As stock prices fell, panic spread, prompting a massive sell-off. This self-reinforcing cycle of fear and selling drove prices down further, showcasing the impact of psychological factors on market dynamics—a lesson that remains relevant in today’s volatile market environments.

The Spread of Fear

Fear spread rapidly among investors, fueled by the dramatic price declines and media coverage of the market turmoil. Rumors and speculation about further losses exacerbated the panic, leading to a cascade of selling. The psychological impact of fear caused rational decision-making to be overshadowed by emotional responses, amplifying the market’s volatility.

Behavioral Economics Insights

The events of 1929 provided early insights into behavioral economics, illustrating how cognitive biases influence investment decisions. Herd mentality, where investors follow the actions of others rather than relying on their own analysis, was prevalent. This collective behavior intensified the market’s downward spiral, as individuals acted in unison, driven by fear and uncertainty.

Lessons for Modern Markets

The role of panic in the 1929 crash underscores the importance of understanding investor psychology in modern markets. Financial professionals must consider the emotional and cognitive factors that drive market behavior, particularly during periods of volatility. By recognizing these influences, investors can develop strategies to mitigate emotional biases and make informed decisions.

The Aftermath and the Great Depression

The crash had profound economic repercussions, marking the beginning of the Great Depression. The ensuing economic downturn was characterized by widespread unemployment, bank failures, and a severe contraction in global trade. The ripple effects of the crash extended far beyond the financial markets, reshaping economies and societies worldwide.

The Human Cost of the Depression

The Great Depression led to devastating social consequences, with millions of people losing their jobs and homes. Unemployment rates soared, reaching unprecedented levels as businesses closed and production halted. The economic hardship affected families across the country, leading to widespread poverty and a decline in living standards. The human cost of the depression was immense, leaving a lasting impact on the collective psyche.

The Collapse of the Banking System

The interconnectedness of banks and the stock market led to a wave of banking failures. As stock prices fell, banks faced liquidity crises, leading to a loss of depositor confidence. The absence of a safety net, such as deposit insurance, meant that bank runs were common, further exacerbating the economic decline. The collapse of the banking system underscored the need for regulatory reforms to prevent future crises.

The Global Economic Contraction

The Great Depression was not confined to the United States; it had global implications. International trade dwindled as countries adopted protectionist policies, leading to a vicious cycle of economic contraction worldwide. The decline in global trade exacerbated the economic downturn, highlighting the interconnectedness of global markets. This underscores the importance of understanding global market linkages and the potential ripple effects of financial crises.

Lessons for Today’s Financial Landscape

Understanding the causes of the 1929 crash offers valuable lessons for contemporary financial professionals. The insights gained from this historical event can inform strategies to navigate today’s complex financial landscape, ensuring greater resilience and stability.

Diversification and Risk Management

For institutional investors, the crash highlights the importance of diversification and robust risk management strategies. By spreading investments across asset classes and geographies, investors can mitigate the impact of market downturns and reduce exposure to speculative bubbles. Diversification serves as a safeguard against concentrated risks, providing a buffer during volatile market conditions.

Proactive Regulatory Engagement

Corporate finance professionals must stay informed about regulatory shifts and their implications. The 1929 crash led to significant regulatory reforms, including the establishment of the Securities and Exchange Commission (SEC). Understanding regulatory environments can help finance professionals develop strategies that align with compliance requirements and optimize capital structures. Proactive engagement with regulators ensures that businesses are well-positioned to adapt to changing regulatory landscapes.

Embracing Technological Innovation

Startup entrepreneurs can learn from the past by embracing innovation while maintaining a cautious approach to new financial technologies. By leveraging fintech solutions, startups can enhance financial operations, streamline processes, and improve customer experiences. However, they must remain vigilant about potential risks and regulatory challenges, ensuring that innovation is balanced with prudent risk management.

Conclusion

The 1929 stock market crash serves as a stark reminder of the complexities and vulnerabilities of financial markets. By examining its causes, today’s financial professionals can gain valuable insights into market dynamics, risk management, and regulatory impacts. Armed with this knowledge, they can make informed decisions, navigate uncertainties, and contribute to a more resilient financial future. The lessons of 1929 continue to resonate, offering timeless guidance for navigating the ever-evolving landscape of global finance.