In recent years, ESG (Environmental, Social, and Governance) investments have gained significant traction in financial markets. As investors increasingly prioritize sustainability and ethical considerations alongside financial returns, understanding the impact of ESG investing on financial markets has become essential. This article explores how ESG investments influence market dynamics, offering insights for institutional investors, corporate finance professionals, and startup entrepreneurs.

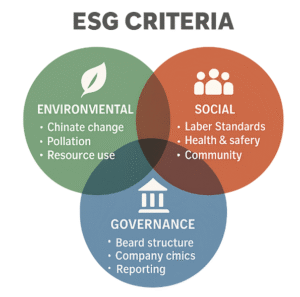

ESG investing refers to the incorporation of environmental, social, and governance factors into investment decisions. The goal is to generate long-term competitive financial returns while making a positive impact on society. ESG criteria cover a broad range of issues, including climate change, human rights, corporate governance, and transparency.

The Rise of ESG Investments

The rise of ESG investments can be attributed to several interrelated factors. Growing awareness of climate change, social inequality, and corporate accountability has prompted investors to consider the broader impact of their financial decisions. Furthermore, changing consumer preferences towards sustainable products and services have accelerated this trend, as companies with strong ESG credentials often enjoy a more loyal customer base. Additionally, regulatory bodies and governments worldwide are pushing for sustainable finance, thus encouraging the integration of ESG criteria into investment strategies. This has led to a proliferation of ESG-focused financial products and services, catering to the increasing demand from both institutional and retail investors.

ESG Investment Strategies

There are several approaches to ESG investing, each with its unique advantages and challenges. Negative Screening involves excluding companies or industries that do not meet specific ESG criteria, such as those involved in fossil fuels or tobacco. This strategy helps investors avoid potential risks associated with unethical or unsustainable business practices. Positive Screening, on the other hand, actively selects companies that exhibit strong ESG performance, rewarding those with exemplary practices in environmental protection, social responsibility, or governance transparency. Thematic Investing focuses on specific ESG themes, such as renewable energy or social equity, allowing investors to align their portfolios with particular societal or environmental goals. Engagement and Stewardship involve actively engaging with companies to improve their ESG performance, often through direct dialogue, proxy voting, or shareholder resolutions. This approach can drive meaningful change within companies and industries, enhancing long-term value creation.

The Role of ESG Ratings and Indices

ESG ratings and indices play a crucial role in guiding investment decisions. These tools provide investors with standardized metrics to assess a company’s ESG performance, enabling comparisons across industries and regions. ESG ratings agencies evaluate companies based on various criteria, assigning scores that reflect their sustainability practices. Meanwhile, ESG indices track the performance of a group of companies that meet specific ESG criteria, offering investors a benchmark for measuring the success of their ESG-focused strategies. As the demand for ESG investments grows, so does the importance of reliable and transparent ESG ratings and indices, which help investors identify opportunities and manage risks more effectively.

ESG Investments and Financial Market Dynamics

Impact on Asset Allocation

ESG investing is reshaping traditional asset allocation models in profound ways. Institutional investors are increasingly integrating ESG factors into their portfolios, leading to a shift in capital flows towards more sustainable asset classes. This shift affects demand for certain asset classes, influencing market prices and volatility. For instance, there is a growing preference for green bonds and socially responsible mutual funds, which can lead to higher valuations and reduced yields for these assets. Moreover, ESG integration in asset allocation strategies encourages diversification, as investors seek to balance financial returns with positive societal impact. This evolution in asset allocation is driven by the recognition that ESG factors can influence long-term financial performance and risk profiles.

Risk Management and ESG

ESG factors are crucial in assessing investment risk, offering insights into potential vulnerabilities and opportunities. Companies with poor ESG practices may face regulatory fines, reputational damage, and operational disruptions, which can adversely impact their financial performance. For example, firms with inadequate environmental policies might incur substantial costs related to pollution fines or cleanup efforts. Conversely, companies with strong ESG practices tend to demonstrate resilience and operational efficiency, reducing investment risk. These companies are often better equipped to adapt to changing regulations, consumer preferences, and market conditions, positioning them for long-term success. Investors increasingly recognize the value of incorporating ESG factors into risk management frameworks, as it enables them to identify and mitigate potential risks more effectively.

ESG Performance and Financial Returns

The relationship between ESG performance and financial returns is a topic of extensive debate, with studies yielding mixed results. While some research indicates that ESG investments can yield competitive returns, others suggest a trade-off between financial performance and sustainable practices. However, the increasing demand for ESG-compliant investments suggests a growing recognition of their value. This demand has driven innovation in sustainable investment products and strategies, fostering a more nuanced understanding of how ESG factors influence financial returns. Furthermore, companies with strong ESG credentials often enjoy benefits such as enhanced brand reputation, customer loyalty, and employee satisfaction, which can translate into improved financial performance. As the body of evidence on the ESG-financial returns relationship continues to grow, investors are better equipped to align their portfolios with their values and financial goals.

ESG and Market Volatility

ESG investments can also influence market volatility, as they drive shifts in capital allocation and investor behavior. The growing emphasis on sustainability has led to increased scrutiny of companies’ ESG practices, which can result in significant market reactions to ESG-related news or events. For instance, revelations of poor environmental practices or governance failures can trigger sharp declines in a company’s stock price, as investors reassess their risk exposure. Conversely, positive ESG developments, such as the adoption of renewable energy initiatives or improved labor practices, can boost investor confidence and drive stock price appreciation. As ESG considerations become more integrated into investment decision-making, they are likely to play an increasingly important role in shaping market dynamics and volatility.

Regulatory Shifts and ESG Investing

Global Regulatory Landscape

The global regulatory landscape is evolving to accommodate ESG considerations, with governments and regulatory bodies introducing policies to promote transparency and accountability in ESG reporting. This shift towards mandatory ESG disclosures is influencing corporate behavior and investment strategies, as companies strive to meet new reporting requirements and align with best practices. In Europe, for example, the EU’s Sustainable Finance Disclosure Regulation (SFDR) mandates that financial market participants provide detailed information on the sustainability of their investments. Similarly, in the United States, the Securities and Exchange Commission (SEC) is considering enhanced ESG disclosure requirements for publicly traded companies. These regulatory developments are driving greater standardization in ESG reporting, enabling investors to make more informed decisions based on consistent and comparable data.

Impact on Corporate Finance Strategies

For corporate finance professionals, understanding regulatory shifts is crucial for developing effective financial strategies. Companies that align their operations with evolving ESG regulations are better positioned to attract investment and mitigate regulatory risks. By proactively addressing ESG issues, companies can enhance their competitiveness, reputation, and access to capital. For example, firms that adopt sustainable supply chain practices or implement robust governance frameworks may enjoy lower borrowing costs and increased investor interest. Additionally, companies that excel in ESG performance are often more resilient in the face of regulatory changes, as they have already integrated sustainability considerations into their business models. As the regulatory landscape continues to evolve, corporate finance professionals must stay informed and agile to navigate the complexities of ESG-related challenges and opportunities.

ESG Reporting and Transparency

Increased demand for ESG transparency is driving companies to enhance their reporting practices, providing investors with the information needed to make informed decisions. Comprehensive ESG reporting covers a wide range of topics, including environmental impact, social responsibility, and governance structures, offering insights into a company’s sustainability performance and future prospects. As a result, companies that excel in ESG reporting are likely to benefit from enhanced investor confidence and improved access to capital. To meet these expectations, many firms are adopting standardized reporting frameworks, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), which facilitate consistent and comparable disclosures. Furthermore, advances in technology, such as blockchain and data analytics, are enabling more efficient and accurate ESG reporting, enhancing transparency and accountability across the investment ecosystem.

Challenges and Opportunities in ESG Regulation

While regulatory shifts present opportunities for companies to enhance their ESG performance, they also pose challenges. Compliance with new ESG regulations can be resource-intensive, requiring significant investments in data collection, reporting infrastructure, and stakeholder engagement. Companies must navigate a complex and evolving regulatory landscape, balancing the need for compliance with the pursuit of business objectives. However, these challenges also present opportunities for innovation and differentiation, as companies that proactively address ESG issues can gain a competitive advantage. By leveraging best practices and emerging technologies, firms can streamline compliance processes, enhance their ESG performance, and position themselves as leaders in sustainable business practices. As the regulatory environment continues to evolve, companies must remain agile and adaptive to capitalize on the opportunities presented by the growing emphasis on ESG considerations.

The Role of Fintech in ESG Investing

Leveraging Technology for ESG Analysis

Fintech solutions are playing a pivotal role in ESG investing, transforming the way investors assess and integrate ESG factors into their decision-making processes. Advanced data analytics and artificial intelligence (AI) tools enable investors to assess ESG performance with greater accuracy, providing valuable insights into companies’ sustainability practices and their potential impact on financial performance. These technologies facilitate the analysis of large datasets, uncovering patterns and trends that may not be apparent through traditional analysis methods. By leveraging fintech solutions, investors can identify companies that align with their ESG criteria, monitor their performance over time, and adjust their portfolios accordingly. Moreover, AI-driven ESG analysis can enhance the objectivity and consistency of investment decisions, reducing the risk of bias and improving overall investment outcomes.

Enhancing Financial Operations

Startup entrepreneurs can leverage fintech solutions to integrate ESG considerations into their financial operations, gaining a competitive edge in the market. By adopting digital platforms and tools, startups can enhance their ESG reporting capabilities, streamline financial processes, and improve their overall operational efficiency. For instance, cloud-based accounting systems can facilitate real-time data collection and reporting, enabling startups to meet regulatory requirements and investor expectations more effectively. Additionally, fintech solutions can support startups in managing their ESG risks and opportunities, providing insights into areas such as energy consumption, supply chain sustainability, and employee well-being. By embracing fintech innovations, startups can position themselves as leaders in sustainable business practices, attracting investment and customer loyalty in an increasingly competitive landscape.

The Future of Fintech and ESG Integration

As fintech continues to evolve, its role in ESG investing is likely to expand, offering new opportunities for innovation and impact. Emerging technologies, such as blockchain and machine learning, hold the potential to revolutionize ESG data collection, analysis, and reporting, enhancing transparency and accountability across the investment ecosystem. Blockchain, for example, can enable secure and tamper-proof tracking of ESG-related data, ensuring the integrity of sustainability claims and facilitating more reliable disclosures. Machine learning algorithms can uncover hidden correlations between ESG factors and financial performance, providing investors with deeper insights into the drivers of sustainable value creation. As these technologies become more integrated into the ESG investing landscape, they will empower investors to make more informed decisions, driving positive change in financial markets and contributing to a more sustainable future.

Conclusion

ESG investments are transforming financial markets by reshaping asset allocation, enhancing risk management, and influencing corporate finance strategies. As regulatory landscapes evolve and technology advances, the importance of ESG investing is set to grow further. Institutional investors, corporate finance professionals, and startup entrepreneurs must embrace ESG principles to navigate the complex financial landscape and achieve sustainable growth.

By understanding the impact of ESG investments and leveraging emerging technologies, stakeholders can make informed decisions that align with their financial goals and contribute to a more sustainable future. The integration of ESG considerations into investment strategies not only offers the potential for competitive financial returns but also supports the transition towards a more equitable and environmentally responsible global economy. As the momentum behind ESG investing continues to build, it is essential for all market participants to stay informed and engaged, ensuring that their actions contribute to a prosperous and sustainable future for generations to come.