In recent years, mobile trading platforms have gained significant traction among both retail investors and institutional players. These applications offer a user-friendly interface, real-time data, and a suite of tools that empower investors to make informed decisions on the go. The convenience of executing trades, monitoring portfolios, and accessing research and analysis from a smartphone or tablet is unparalleled.

Accessibility and Convenience

Mobile trading platforms have dismantled the traditional barriers to entry, allowing individuals from various backgrounds to engage in stock markets effortlessly. For students, retirees, or part-time investors, these platforms offer an opportunity to participate in trading without the need for substantial capital or connections. Additionally, the ability to trade from anywhere at any time has made it easier for entrepreneurs to incorporate stock market investments into their busy schedules, enhancing their financial portfolios.

For institutional investors, the convenience of mobile trading platforms means they can respond to market changes swiftly, without being confined to their office desks. This flexibility is particularly beneficial in volatile markets where rapid response times can significantly impact outcomes. Moreover, mobile trading apps often sync with other financial tools, enabling a seamless integration into existing investment workflows and enhancing overall efficiency.

Cost Efficiency

The cost efficiency of mobile trading apps is revolutionizing how transactions are handled. Unlike traditional brokerages that often charge hefty commissions, many mobile platforms offer zero-commission trading, allowing investors to maximize their returns. This shift is not only attracting a new wave of young and cost-conscious investors but also prompting seasoned traders to reassess their strategies to incorporate more frequent trades without the worry of accumulating fees.

For corporate finance professionals, the reduction in transaction costs translates into improved capital allocation strategies. With lower overheads, companies can deploy their resources more effectively, increasing potential returns and enabling more innovative financial solutions. The cost savings also free up funds for additional investments in technology and human resources, further enhancing the capabilities of financial institutions.

User Experience and Design

The user experience of mobile trading platforms plays a crucial role in their widespread adoption. Intuitive design, coupled with user-friendly navigation, ensures that even novice traders can navigate the complexities of stock markets with ease. The inclusion of educational resources within these apps also supports users in understanding market trends, financial instruments, and trading strategies.

For experienced traders, advanced charting tools and customizable dashboards allow for a personalized trading experience, enhancing decision-making processes. The seamless integration of news feeds and alerts keeps users informed of market developments, enabling them to act on opportunities as they arise. This focus on user experience is key to maintaining engagement and encouraging long-term use of the platforms.

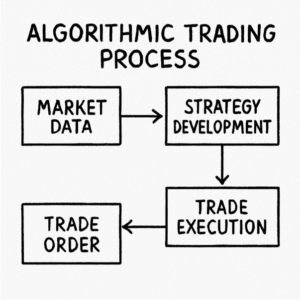

Algorithmic Trading: A Game Changer

Algorithmic trading, the use of computer algorithms to execute trades based on predetermined criteria, has become increasingly prevalent in the mobile trading sphere. This technology allows for the rapid execution of trades, capitalizing on market inefficiencies and trends with precision and speed that human traders cannot match.

Enhancing Decision Making

For institutional investors, algorithmic trading is a transformative tool that enhances decision-making processes. By analyzing vast datasets, these algorithms can identify patterns and predict market movements, allowing for strategic trade execution. This capability significantly reduces the risk of human error, providing a level of accuracy and speed unattainable through manual trading processes.

Moreover, algorithmic trading enables investors to implement complex strategies across multiple markets simultaneously, optimizing their portfolios for maximum returns. The ability to execute trades based on predefined parameters ensures consistency in investment strategies, aligning them with broader financial goals and risk management policies.

Democratization of Advanced Trading

Historically, algorithmic trading was the domain of large financial institutions with substantial technological infrastructure. However, mobile apps have brought this capability to a broader audience, including savvy retail investors and startup entrepreneurs. By integrating algorithmic trading features into mobile platforms, developers have empowered users to leverage sophisticated strategies without the need for specialized expertise.

This democratization of advanced trading strategies is leveling the playing field, allowing smaller investors to compete with larger entities. Access to algorithmic trading tools means that users can automate their trades based on customized criteria, freeing up time for other investment activities. This shift is fostering a more inclusive financial market, where success is driven by strategy and insight rather than sheer capital.

The Role of Artificial Intelligence

The integration of artificial intelligence (AI) in algorithmic trading is further revolutionizing the stock market landscape. AI algorithms can process vast amounts of data in real-time, learning from market trends and adapting strategies accordingly. This dynamic approach enables traders to stay ahead of market shifts, enhancing their ability to capitalize on emerging opportunities.

AI-driven algorithms also facilitate the development of predictive models that can forecast market movements with increasing accuracy. These insights are invaluable for both institutional and retail investors, providing a competitive edge in decision-making processes. As AI continues to evolve, its role in algorithmic trading will undoubtedly expand, offering even more sophisticated tools for navigating the complexities of the stock market.

The Impact of Stock Market Technology

Stock market technology is not only transforming how trades are executed but also how data is consumed and analyzed. Innovations in this space are providing investors with deeper insights and more robust risk management tools.

Real-Time Data and Analytics

Mobile apps offer real-time access to market data, news, and analytics, enabling investors to stay informed about market movements and make timely decisions. This constant flow of information is critical for corporate finance professionals tasked with developing strategies that adapt to regulatory shifts and market dynamics.

The availability of real-time data also empowers investors to react swiftly to global events that impact financial markets. Whether it’s geopolitical developments, economic reports, or corporate earnings announcements, having immediate access to information ensures that investors can make informed decisions that align with their financial objectives.

Risk Management and Strategy Optimization

The integration of advanced analytics into mobile trading platforms enhances risk management capabilities. Investors can simulate various scenarios, backtest strategies, and adjust their approaches based on data-driven insights. This level of strategic planning is invaluable for institutional investors seeking to optimize their portfolios and achieve higher returns.

For retail investors, access to risk management tools within mobile apps provides a newfound level of confidence in their trading activities. By understanding the potential risks and rewards associated with different investment strategies, users can make more informed decisions, reducing the likelihood of significant financial losses. This empowerment is fostering a more educated and resilient investor base.

Personalization and Customization

Stock market technology is increasingly focusing on personalization and customization, ensuring that investors receive insights that are relevant to their specific needs. Mobile trading platforms often offer features that allow users to tailor their dashboards, news feeds, and alerts according to their investment preferences.

This level of customization enhances user engagement, as investors are more likely to interact with a platform that aligns with their unique financial goals. Additionally, personalized insights and recommendations can help users identify new opportunities and refine their strategies, ultimately leading to more successful investment outcomes.

Regulatory Considerations and Compliance

by Marga Santoso (https://unsplash.com/@margabagus)

As mobile trading platforms continue to evolve, regulatory considerations remain a paramount concern. Ensuring compliance with evolving regulations is essential for maintaining investor trust and safeguarding the integrity of financial markets.

Navigating Regulatory Shifts

Corporate finance professionals and institutional investors must stay abreast of regulatory changes that impact trading practices. Mobile apps often incorporate compliance features that help users adhere to legal requirements, providing peace of mind and reducing the administrative burden associated with regulatory compliance.

These features include automated reporting tools, alerts for regulatory changes, and integrated compliance checklists that ensure all trading activities meet legal standards. By leveraging these tools, investors can focus on their core trading activities, confident that their compliance needs are being effectively managed.

Security and Data Privacy

Security remains a top priority for mobile trading platforms. Protecting sensitive user data and ensuring secure transactions are critical components of maintaining user confidence. As such, many platforms employ robust encryption protocols and multi-factor authentication to safeguard against cyber threats.

In addition to technical security measures, mobile platforms are increasingly emphasizing the importance of user education in maintaining data privacy. By providing resources and guidance on secure trading practices, platforms are empowering users to take an active role in protecting their information. This collaborative approach to security enhances the overall resilience of mobile trading ecosystems.

Ethical Considerations and Transparency

As the use of mobile trading platforms grows, ethical considerations surrounding transparency and fair trading practices are becoming increasingly important. Investors expect platforms to uphold high standards of integrity, ensuring that all users have equal access to information and trading opportunities.

Platforms that prioritize transparency in their operations foster a sense of trust among users, contributing to a more equitable financial market. By clearly communicating fees, risks, and the methodologies behind algorithmic trading strategies, platforms can maintain investor confidence and support the long-term sustainability of mobile trading ecosystems.

Conclusion

Mobile apps are revolutionizing stock market access by providing a convenient, cost-effective, and technologically advanced means of trading. By embracing algorithmic trading and leveraging cutting-edge stock market technology, investors across the spectrum—from institutional players to startup entrepreneurs—can navigate the complexities of capital markets with greater agility and confidence. As these platforms continue to evolve, they will undoubtedly play an increasingly pivotal role in shaping the future of global finance.

The democratization of stock market access through mobile technology represents a significant step forward in the ongoing evolution of financial markets. By empowering a diverse range of investors with the tools and insights needed to succeed, these platforms are laying the groundwork for a more inclusive and dynamic financial ecosystem. The continuous innovation in mobile trading technology promises to bring even more transformative changes, further leveling the playing field and expanding opportunities for investors worldwide.