In this article, we will explore the current trends in impact investing, define what it truly means, and forecast its future outlook in the ever-evolving financial markets. Understanding these aspects is crucial for investors and stakeholders aiming to align their portfolios with sustainable development goals and ethical investment principles.

What is Impact Investing?

Impact investing refers to investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. It challenges the traditional dichotomy between philanthropic donations and profit-driven investments by integrating the two objectives. This approach caters to a new generation of investors who seek to make a difference in the world while also achieving financial growth.

Impact investments are often directed towards sectors like renewable energy, education, healthcare, and sustainable agriculture, where the potential for societal impact is significant. By actively choosing where their money goes, investors can influence corporate behaviors and encourage companies to adopt more sustainable practices. This creates a cycle where financial success is intertwined with social progress, ultimately benefiting communities and ecosystems worldwide.

The Rise of Socially Responsible Investing

The concept of socially responsible investing (SRI) has been around for decades, focusing on avoiding investments in industries that have negative social or environmental impacts, such as tobacco or firearms. However, impact investing goes a step further by actively seeking out opportunities that contribute to societal goals, such as affordable housing, renewable energy, and healthcare access. Unlike SRI, which often involves negative screening, impact investing is proactive, targeting investments that explicitly seek to solve social issues.

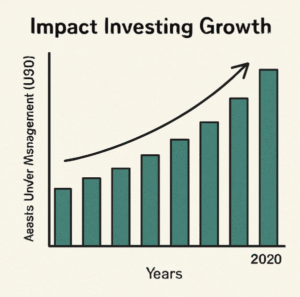

The increasing demand for transparency and accountability from investors has propelled the growth of impact investing. This trend signifies a shift in investor priorities, where financial return is increasingly evaluated alongside social and environmental impact. As consumers become more informed and conscious about their choices, companies are pressured to align their operations with sustainable practices, thus expanding the universe of impact investment opportunities. This shift also reflects a broader cultural change towards valuing corporate responsibility and ethical business practices.

Current Trends in Impact Investing

Increased Allocation to Impact Funds

Institutional investors are allocating more capital to impact funds as they recognize the potential for competitive returns. This shift is driven by the growing body of evidence suggesting that impact investments can outperform traditional investments over the long term, particularly as consumer preferences lean towards sustainable products and services. The proliferation of impact-focused investment vehicles, such as green bonds and social impact bonds, has made it easier for investors to allocate funds towards sustainable ventures.

Moreover, pension funds and endowments, traditionally cautious in their investment strategies, are increasingly embracing impact investing as part of their fiduciary duty to manage risks and ensure long-term value creation. This trend underscores a broader acceptance that sustainability and profitability are not mutually exclusive, but rather complementary components of a robust investment strategy.

Regulatory Support and Frameworks

Governments and international organizations are introducing regulations and frameworks to support and standardize impact investing. Initiatives like the European Union’s Sustainable Finance Disclosure Regulation (SFDR) and the United Nations’ Sustainable Development Goals (SDGs) provide guidelines that encourage transparency and accountability in impact investments. These regulations aim to create a level playing field, ensuring that all market participants adhere to the same standards and commitments.

Such frameworks also help protect investors from greenwashing, where companies falsely claim to adhere to sustainable practices. By establishing clear criteria for what constitutes an impact investment, regulators can enhance investor confidence and facilitate the growth of this market segment. This regulatory support is crucial in mobilizing capital towards projects that can drive meaningful change, particularly in areas that are often underserved by traditional finance.

Technological Advancements and Data Analytics

The integration of technology in financial markets has revolutionized impact investing. Advanced data analytics and artificial intelligence are now used to measure and track the social and environmental impact of investments accurately. These tools enable investors to make informed decisions based on real-time data, improving the efficiency and effectiveness of their investment strategies. With access to granular data, investors can assess the direct and indirect impacts of their investments, allowing for more strategic allocation of resources.

Furthermore, technology has facilitated greater transparency and accountability in impact investing. Blockchain, for example, offers a way to track the flow of funds and verify the outcomes of investments, ensuring that capital is used as intended. As technology continues to evolve, it will likely play an even more significant role in enhancing the credibility and scalability of impact investments.

Collaboration and Partnerships

Collaboration between public and private sectors is crucial for scaling impact investments. Partnerships among governments, financial institutions, and non-profits are forming to leverage resources and expertise, thereby maximizing the social and environmental benefits of impact investments. These collaborations are essential in addressing complex global challenges that require coordinated efforts and diverse perspectives.

For instance, public-private partnerships can help bridge funding gaps in critical sectors like infrastructure and healthcare, where the need for investment is vast but often underserved. By pooling resources and sharing risks, these partnerships can unlock opportunities that might otherwise be too daunting for a single entity to tackle alone. As the impact investing ecosystem matures, such collaborations will be instrumental in driving systemic change and achieving sustainable development goals.

Future Outlook of Impact Investing

Expansion into New Markets

The future of impact investing looks promising, with potential expansion into emerging markets. These regions offer significant opportunities for impact investments due to their developmental needs and rapidly growing economies. As local governments and private sectors become more open to sustainable practices, impact investing can play a pivotal role in driving economic growth while addressing social challenges. By investing in infrastructure, education, and healthcare, impact investors can help build resilient communities that are better equipped to face future challenges.

Furthermore, the rise of local entrepreneurs and startups focused on social innovation presents new avenues for impact investors. These businesses are often at the forefront of creating scalable solutions to societal issues, making them attractive targets for investors seeking both financial returns and social impact. As the global landscape evolves, impact investing will likely become an integral part of development strategies in these burgeoning markets.

Enhanced Measurement and Reporting Standards

As impact investing matures, the need for standardized measurement and reporting practices becomes more critical. Investors are demanding clearer metrics to evaluate the success of their investments in achieving social and environmental outcomes. The development of comprehensive reporting frameworks will enhance transparency and accountability, building trust among investors and stakeholders. These standards will help ensure that impact claims are substantiated by concrete evidence, reducing the risk of misinformation and enhancing market integrity.

Moreover, standardized reporting can facilitate better comparisons across investments, helping investors identify the most impactful opportunities. As these practices become more widespread, they will likely encourage greater participation in the impact investing market, as investors gain confidence in their ability to assess and achieve desired outcomes.

Integration with Traditional Investment Portfolios

Impact investing is increasingly being integrated into traditional investment portfolios as investors recognize its potential to diversify risk and enhance overall returns. Financial advisors and asset managers are adopting blended strategies that incorporate impact investments alongside conventional assets, offering clients a holistic approach to wealth management. This integration reflects a growing understanding that impact investments can complement traditional assets, providing exposure to high-growth sectors and mitigating potential risks associated with unsustainable business practices.

By aligning portfolios with sustainability goals, investors can better manage long-term risks and capitalize on emerging opportunities. As awareness of the benefits of impact investing spreads, it is likely to become a standard component of diversified investment strategies, appealing to a broad range of investors seeking both financial and non-financial returns.

Conclusion

Impact investing is no longer a niche market; it is a mainstream strategy with the potential to reshape the future of finance. By aligning financial goals with societal and environmental objectives, investors can achieve competitive returns while contributing to a more sustainable world. This dual focus is becoming increasingly essential as global challenges such as climate change and social inequality demand innovative and collaborative solutions.

Institutional investors, corporate finance professionals, and startup entrepreneurs all stand to benefit from embracing impact investing. As the market continues to evolve, staying informed about trends and innovations will be crucial for those looking to leverage impact investing to achieve their financial and societal goals. This proactive approach not only supports individual investment success but also contributes to the broader movement towards a sustainable global economy.

In conclusion, impact investing offers a promising pathway towards a sustainable future, where financial prosperity and positive social change go hand in hand. As we move forward, the collaboration between investors, governments, and communities will be key to unlocking the full potential of impact investing and driving meaningful change on a global scale. The continued evolution of this field holds the promise of transforming how we think about and approach investment, making it a vital tool in the pursuit of a just and sustainable world.